No industry has been more impacted by the global pandemic than the travel industry. With 96% of countries having employed some form of mobility restrictions, the world has gone from Global to Hyperlocal in an incredibly short 3-month window. This concentrated timeframe has forced many businesses to adopt new digital technologies to mitigate the impact from the crisis, from supply chains to customer engagement, maintaining global operations whilst being confined to the home.

The easing of restrictions across the East, and now West, and travel bubbles/corridors/airbridges between countries, we are starting to see the short-term recovery of the travel industry. However, with companies inevitably looking to tighten their purse strings, introduce new sustainability targets and introduce or maintain effective virtual communication technologies, is this the end of business travel as we know it?

Business Travel Resilience

We know that following the SARS pandemic, travel recovery to pre-outbreak levels in worst hit regions took 6-7 months from impact. Whilst the current crisis is global and has had a far greater impact than anything that has come before it, history shows us that travel is resilient, typically revived by business travel first.

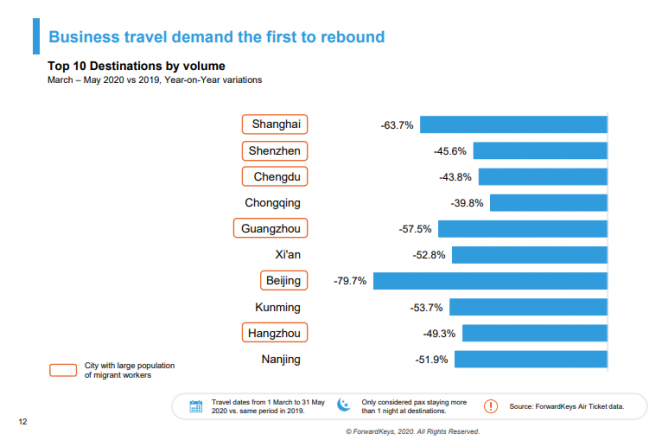

In fact, China, which by the end of May had seen a 50% recovery in their domestic market, saw that the easing of air travel restrictions between Chinese provinces led to business travel demand being the first to rebound, according to Flight analytics company ForwardKeys.

Recent research by London City, a predominantly business focused airport, supports this. Interviews amongst 4,700 of its customers revealed 79% were either ‘very likely’ or ‘quite likely’ to travel when the government and airports or airlines have said it is safe to do so – with 41% saying they will take a flight for business within the next three months. JCDecaux Airport haw conducted a similar survey among 200 UK residents. As part of this research it explored the attitudes of 111 business decision makers (BDMs) who have flown through its airports, including London Heathrow and Edinburgh. The data shows that over 70% of BDMs expect their organisations to have resumed business travel by the end of 2020.

However, despite these positive signs, travel research specialists M1ndset indicate that 33% of business travellers surveyed are considering less or no business travel in the six months from travel restrictions being lifted.

There are several factors which will play into the recovery of the travel industry and how we operate within it.

Digital Enablement

Digital platforms like Microsoft Teams and Zoom have been vital in keeping businesses and their employees connected during the pandemic, without the need to travel. The successful adoption of these technologies will result in many businesses needing to justify the environmental, financial and time impact for business travel in the immediate future. However, along with the success of online communications technologies, their adoption has also highted their limitations, namely that they are not a long-term replacement for face to face meetings that provide unique instances of interaction that cannot be felt online. A study by JCDecaux shows that 89% of business decision makers feel that ‘in person’ meetings are more important to their business than video calls, which is probably why 20% of their respondents have not replaced international meetings with calls in 2020.

In addition, during lockdown, many businesses have been forced to host their conferences online. V-Fairs, a virtual event’s hosting company, report that it is receiving 10x – 12x more international enquiries compared to the same period last year. Despite the necessary shift from physical to virtual, only 19% of those surveyed by m1ndset believe future events will be cancelled. Instead, it is likely that brands that have enjoyed online events may resort to hybrid events in the future (a combination of both formats operating simultaneously). Although companies like V-Fairs are enjoying the recent boom in business, they too understand that once lockdown measures are eased and travel resumes, face to face events will make a return.

The immediate shape of the recovery

Companies will need to consider the health-related risks associated with air travel and imposed quarantine on arriving passengers, which could in the short term, deter both business and leisure travellers. However, new touchless technologies coupled with the easing of travel restrictions via agreed travel corridor/airbridges, are shaping the recovery of business travel. These travel corridor agreements are paving the way for the resurrection of short haul trips for trade and essential business travel. Travel airbridges have emerged between Australia and New Zealand, the Baltics, Cambodia, and Vietnam, and will continue to grow over the coming weeks.

Alongside this, we are also seeing private jet travel increasing. As restrictions started coming in to effect, private jet demand surged as passengers looked for a perceived safer and more convenient way to travel – mitigating any potential delays. Aviation consultancy WingX reported an increase of 214% in flights from Hong Kong to Australia and North America in January 2020.

Private Jet Media tells PSI “Social distancing will still be a major trend for the next 6-12 months, even after the virus is no longer a serious threat. Business aviation has always naturally operated in a social distancing mode. For many private jet terminals, it’s an unspoken rule of thumb to separate groups of passengers on each flight,.” For these reasons private jets will have a great influence over how C-suite and other more targeted profiles, like ultra-high net worth individuals, travel post pandemic.

PSI believes we are entering a new phase in mobility post lockdown, where a higher concentration of C-suite travellers will lead the short-term recovery of the business travel sector. This will only be feasible should air routes continue to reopen, government-imposed quarantines become a thing of the past and a second wave is avoided or managed well enough with little to no impact on world economies. With this, the shape of travel will change, with an emphasis on convenience and efficiency of travel, as provided by private jets, cross border express trains, helicopters, etc. JCDecaux’s study reflects this move towards efficiency and convenience with 64% of BDMs intending to “avoid contact as much as possible with other passengers, and use Lounges and Fast Track wherever possible”

For B2B brands, the airport location is an ideal place to reach the business traveller whilst in a business frame of mind. However, this is not the only relevant environment.

As companies make the careful steps in reopening offices, media opportunities such as with ECN, Europe’s leading workplace media communications specialist, can also become important in targeting business audiences.

Data, Flexibility & Innovation

With the rise in business mobility, comes the need to be able to interpret and effectively apply mobility data and insight. Using our data partnerships and location intelligence, PSI has created a dynamic global mobility index (GMI) that allows for the understanding of each market’s travel patterns. This, in partnership with PSI’s ‘Response-Recovery-Return Planning Framework’, has provided many brands with the tools to effectively read these data signals and adapt location media strategies and messaging to their audiences.

Advances in data, analytics and the digitalisation of the OOH landscape are empowering global media owners and PSI to adapt to this future, allowing for new sophisticated and flexible audience-led buying in OOH to become a reality. This approach is paving the way towards the possibility of global programmatic OOH solutions, enabling campaigns to be planned, bought and served to diverse audience profiles, including business segments, minimising wastage and maximizing the potential for personalized communication strategies for brands across the world.

Business travel is accustomed to disruption, whether triggered by terrorism, geo-political change, recessions, environmental events or, as we are currently experiencing, viral outbreaks. However, it is digital transformation that will have the most profound impact on the future of business travel. Whilst it will take time to recover to pre-Covid levels, concentrated levels of c-suites and business decision makers will in the short term shape the recovery of global business travel. As global mobility patterns change, it is essential that a brand can interpret the right data signals to understand each market’s response-recovery-return phase and adapt its communication strategies accordingly. The flexibility and targeting capabilities that OOH now provides cannot be underestimated, and PSI and its partners are working together to provide more audience guaranteed buying possibilities, that will usher in the next stage of global programmatic OOH.